.png)

The voluntary carbon market faced strong headwinds in 2023 – a reckoning due to carbon credit quality problems. The silver lining that could arrive in 2024: A market correction that can support a new VCM 2.0, rebuilding a market that is good for the planet and for people.

Author: Donna Lee

If 2023 was a year of reckoning for the carbon market, 2024 just might be the year of market correction. I know what you’re thinking, “you’re just an industry player trying to convince everyone it’s going to be okay.” Well, I’m not. I’ve spent my career evaluating carbon project quality and I’ve always been forthright about shortcomings. In fact, I have a reputation for being a tough critic.

Credits traded in carbon markets represent an incentive to remove or prevent greenhouse gases from going into our atmosphere – a critical part of the climate solution discussed at COP28. Despite good intentions, the carbon projects that produce these credits haven’t always done the good they claim. So how do we point an important yet challenged multi-billion dollar carbon market in a better direction?

Out with the bad

The first step is to improve or remove what is weighing the market down. There are two project types that have comprised nearly 50% of voluntary market issuances* – avoided deforestation (REDD) and renewables. We need to reform REDD and reconsider renewable energy credits because both of these asset classes in the voluntary carbon market are known to have integrity issues. That does not mean every one of these projects produces low-quality credits, but a majority of them do.

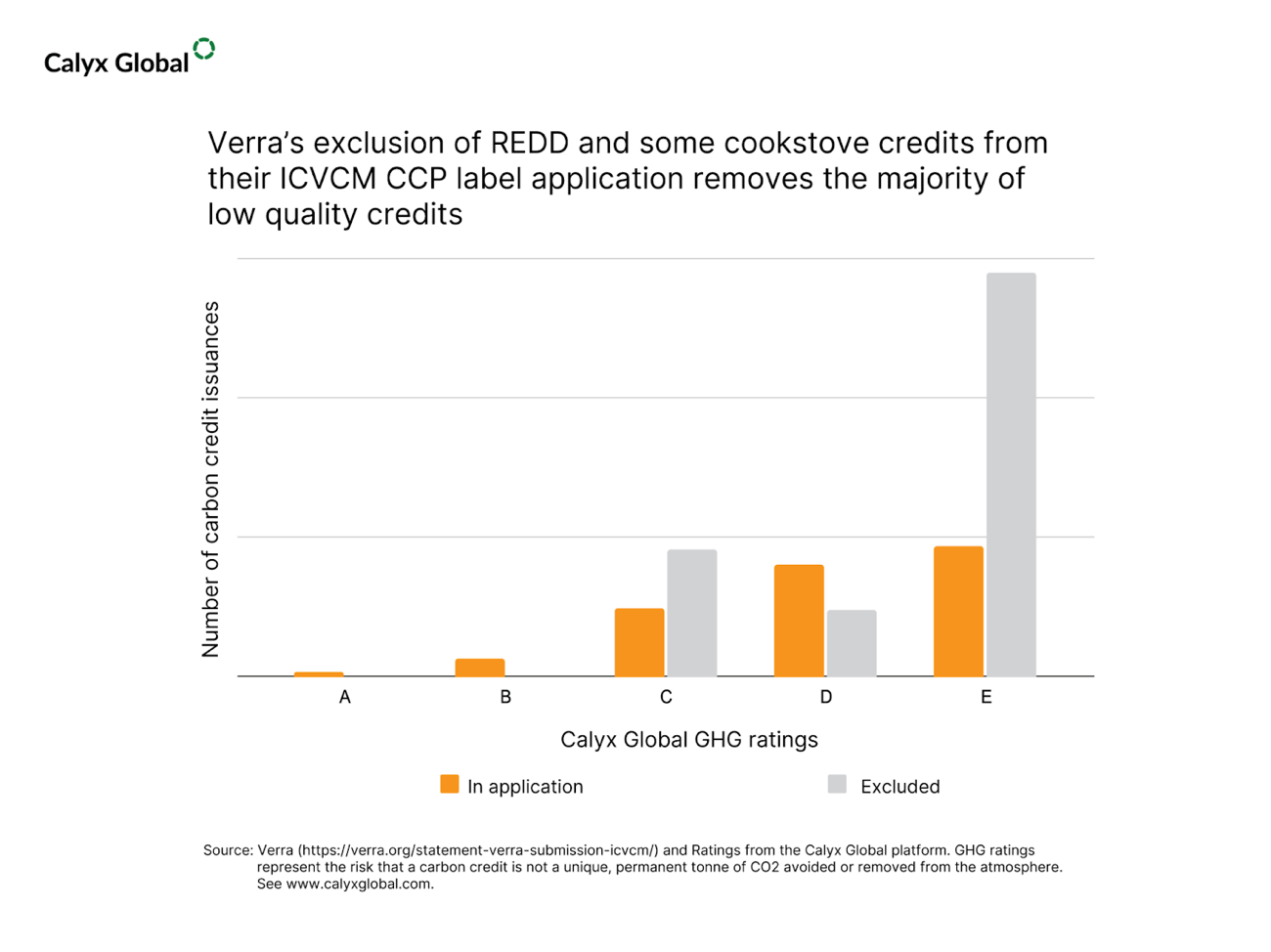

The carbon market standards body that certifies the lion’s share of avoided deforestation projects, Verra, has taken action to reform REDD. They have also decided to not pursue, for their existing REDD credits that utilize the old approach, a coveted new industry label that is intended to indicate a minimum level of quality. This “Core Carbon principles” or CCP label will be designated by the ICVCM – a newly established industry guidelines setter. Our analysis confirms that this move by Verra goes a long way to helping with the market correction.

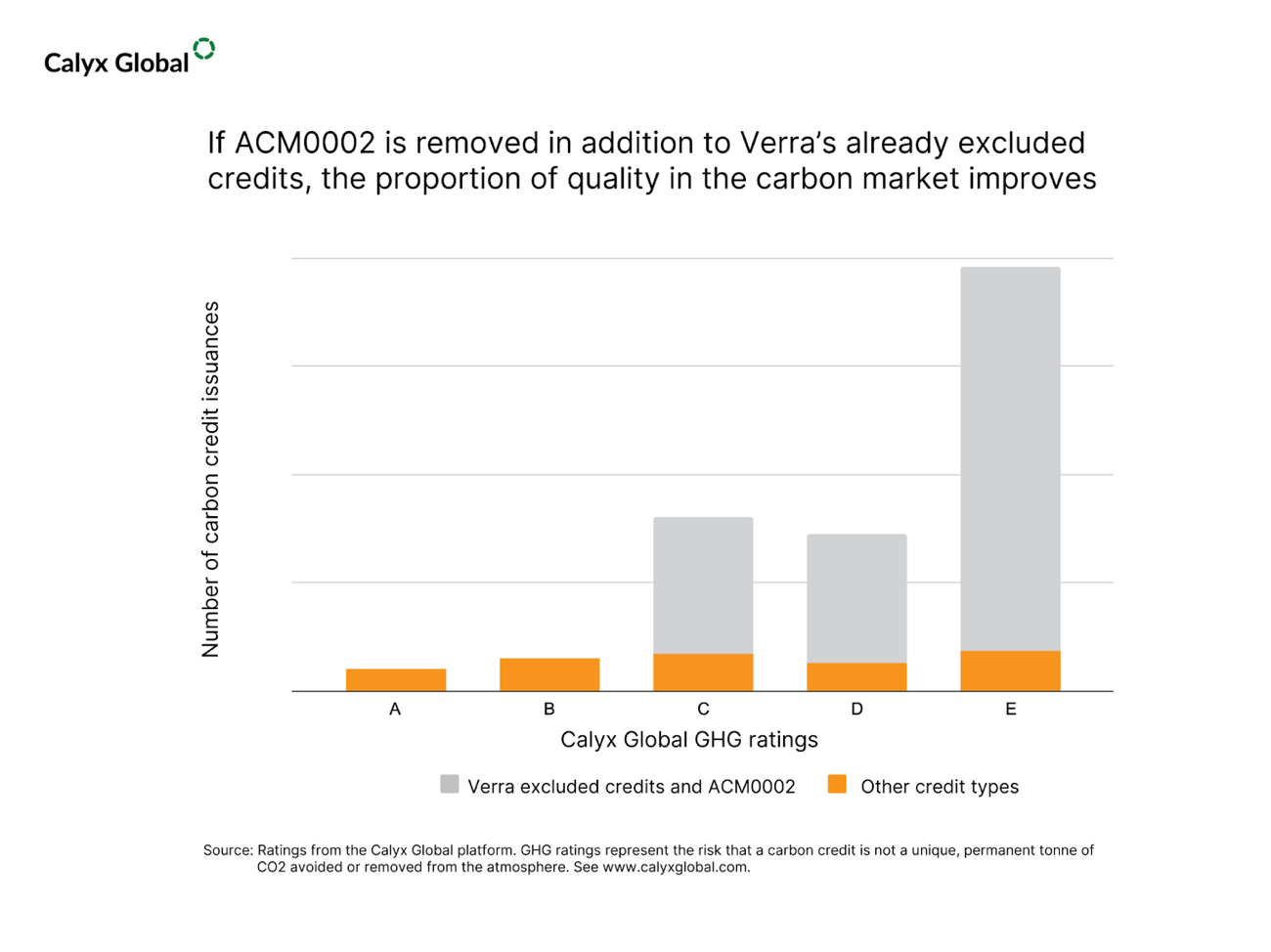

The next major problem in the market is large-scale, grid-connected renewable energy projects. These are largely wind, solar and hydropower projects using a particular methodology called ACM0002. An analysis of over 100 of these projects shows their greenhouse gas impact claims are risky, resulting in relatively poor grades in Calyx Global’s credit rating system. Verra and the Gold Standard – two major carbon credit registries – have stopped registration of such projects. An exception is made for renewable projects in particularly poor (least developed) countries.

These two actions alone: excluding ACM0002 projects together with Verra’s voluntary exclusion of the “old” REDD credits, go a long way towards a necessary market correction. This can be the beginning of a higher quality “carbon market 2.0” that society needs. However, removing 50% of credits from the carbon market would significantly reduce supply, with a likely impact on pricing and availability in the near term. This could lead to a degree of uncertainty and volatility but should, in the medium term, mean a stronger quality-linked price signal and a strong incentive for the development of high-integrity supply.

In with the good

So where will the higher-integrity new supply in carbon markets 2.0 come from?

We can look at which carbon projects are performing well. In Calyx Global’s analysis of over 450 projects, 41 projects were rated at our highest “A” level, and another 84 were rated at the “B” level. These projects span a variety of sectors – from industrial gas destruction to tree planting, or reducing methane from landfills or livestock to providing clean cooking to rural households. We also expect that some “old REDD” credits may transition to the new Verra methodology and could enter this higher-integrity range.

Creating higher-quality carbon credits is not intractable or insurmountable. As in any market, carbon market outcomes are created by incentives – and the problem is that to date, the primary incentive has been for credit issuers to maximize volume and not integrity, or quantity over quality.

However, new players in the voluntary market ecosystem are developing a number of incentives to reward quality, including:

- A label that indicates a minimum quality threshold as set by The Integrity Council for Voluntary Carbon Markets (ICVCM) CCPs. The first such labels are expected to emerge early next year.

- Carbon credit ratings, such as those generated by Calyx Global and others that create value through higher ratings for higher-integrity credits.

- A push by larger players to move investment “upstream,” where they secure their own supply of promising, new higher-integrity credits by funneling money towards new projects.

“Build integrity, and scale will follow.”

These supply-side developments have the potential to reset carbon markets, with integrity more explicitly integrated in available supply and in price discovery. This transition to higher-integrity credits is just the outcome that carbon market stakeholders, Calyx Global and others are working towards. In the words of the ICVCM: “Build integrity, and scale will follow.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.