In a new report, Calyx Global presents lessons learned from analyzing 73 projects covering 94% of the credits that have been issued from carbon projects that aim to reduce deforestation and forest degradation (REDD). This popular project type has issued over 425 million carbon credits. Ideally, these credits help protect nature, empower local people and stabilize our climate. In a recent blog, we showed how such projects do, in fact, contribute to sustainable development and local communities. However, from a GHG integrity perspective, REDD credits are risky. But they don’t have to be.

In this summary, we provide our key recommendations on how to turn REDD credits from a trade-off (of high SDG benefits for questionable GHG impact) into a win-win.

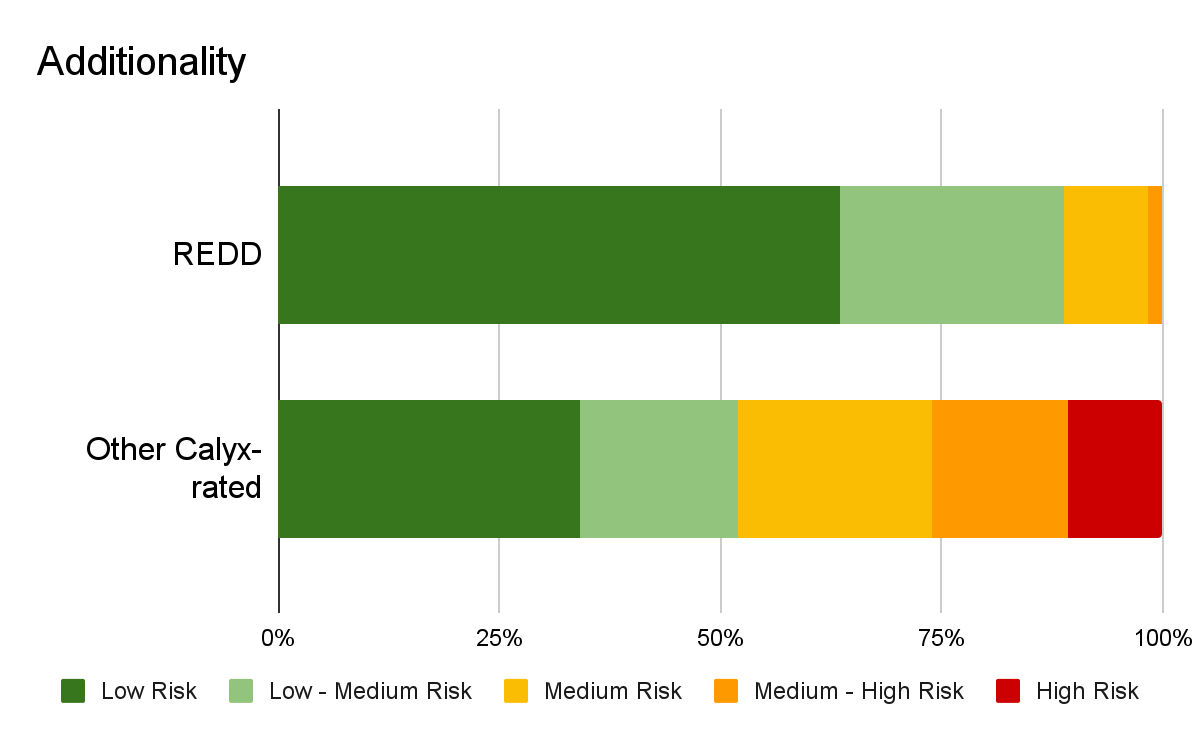

Additionality: Demonstrate “prior consideration” and the impact of carbon finance. At Calyx Global, the question “Would project activities have occurred without carbon revenue?” is paramount. After all, the purpose of mobilizing carbon finance is to achieve greater climate impact. We find that, for most REDD projects, we have high confidence in the project’s additionality. In most instances we believe the activities would not occur without carbon finance.

Two issues, however, can increase the risk of non-additionality. First, in just under a quarter of all projects, we see a lack of evidence that the project considered carbon finance prior to the start of implementation. Second, about half of the projects assessed did not adequately demonstrate the importance of carbon finance.

VCS could improve its methodologies to require these elements – or projects can voluntarily provide this information in their registry documentation. That said, additionality is not REDD’s biggest problem, and that is fortunate, because it is the most important factor in Calyx Global’s ratings.

REDD projects generally have lower risks of non-additionality than other project types.

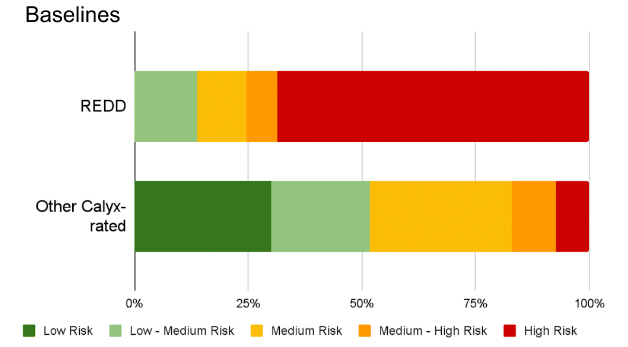

Baselines: Choose a plausible trajectory of deforestation. The baseline establishes the amount of deforestation that would have happened in the absence of the project. Our analysis finds that almost two-thirds of REDD projects have a risk of an overestimated baseline that is 80% greater than (almost twice as high as) alternative baselines derived from our independent spatial modeling and analysis. Only 25% of projects we assessed had baselines that were overestimated by less than 50%.

REDD projects have a higher risk1 of baseline overestimation than other project types.

Want more information on how we create alternative baselines? Check out our white paper “Turning REDD into GREEN”.

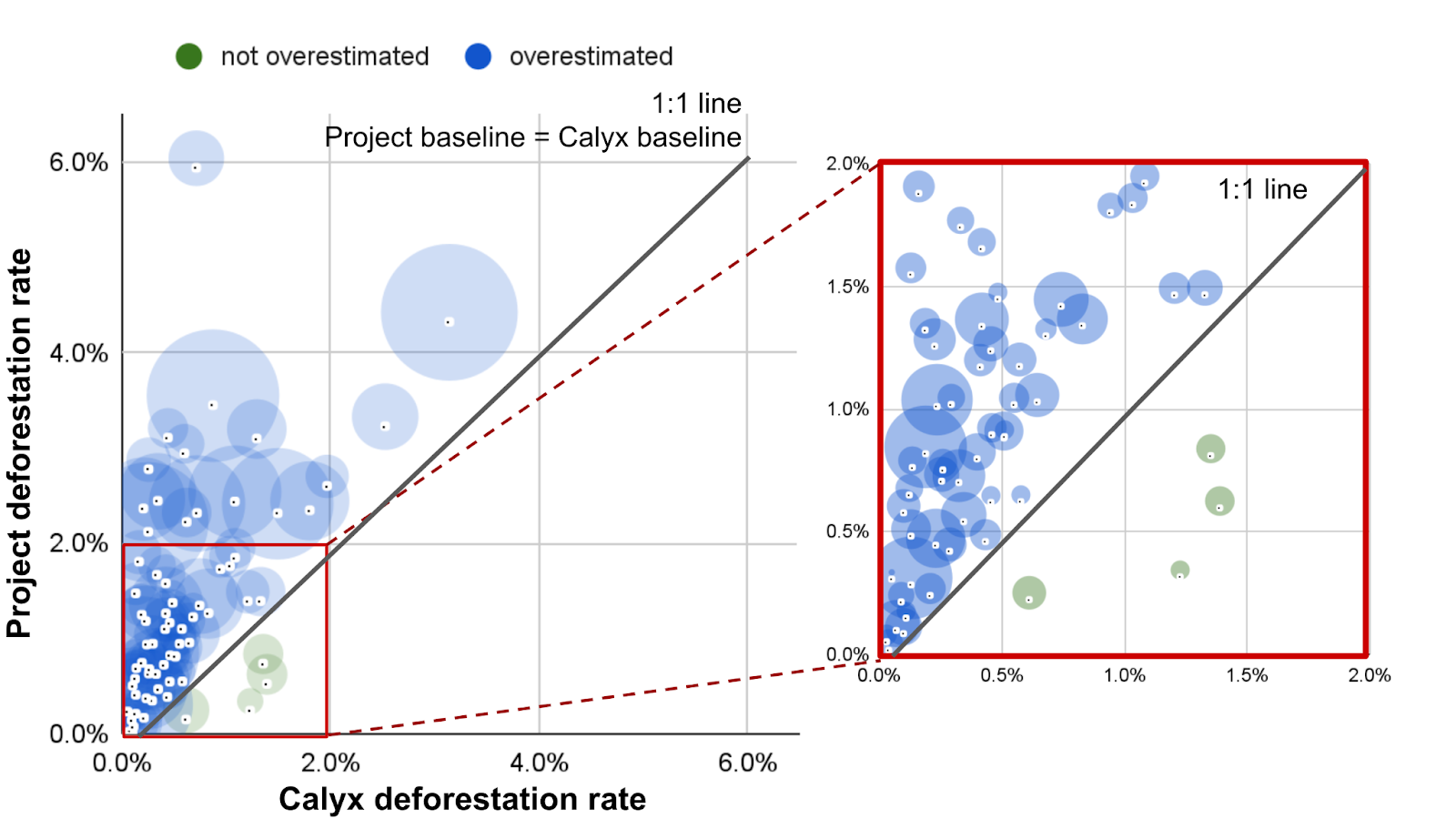

Baseline overestimation is pervasive and substantial, ranging from under 25% to over 1100%. Of the 73 project baselines we have assessed, only four projects’ claimed deforestation rate (y axis below) was lower than the rate estimated by Calyx Global (x axis below). We also found that good baselines are determined by the project, not by the environment. Low-risk baselines are not limited to certain countries or regions, high or low deforestation risk, large or small projects. They are determined by a series of conservative decisions within the bounds of existing methodologies.

Project deforestation rate versus Calyx Global deforestation rate. The black 1:1 line indicates where points should lie if the project deforestation rate is the same as that predicted by Calyx Global. Points above the line indicate that the project rate is higher than expected (overestimated); points below the line indicate that the project rate is lower than expected (they could realistically claim more forest loss than they do). The red box on the left is expanded on the right to show more detail for projects with a deforestation rate under 2%.

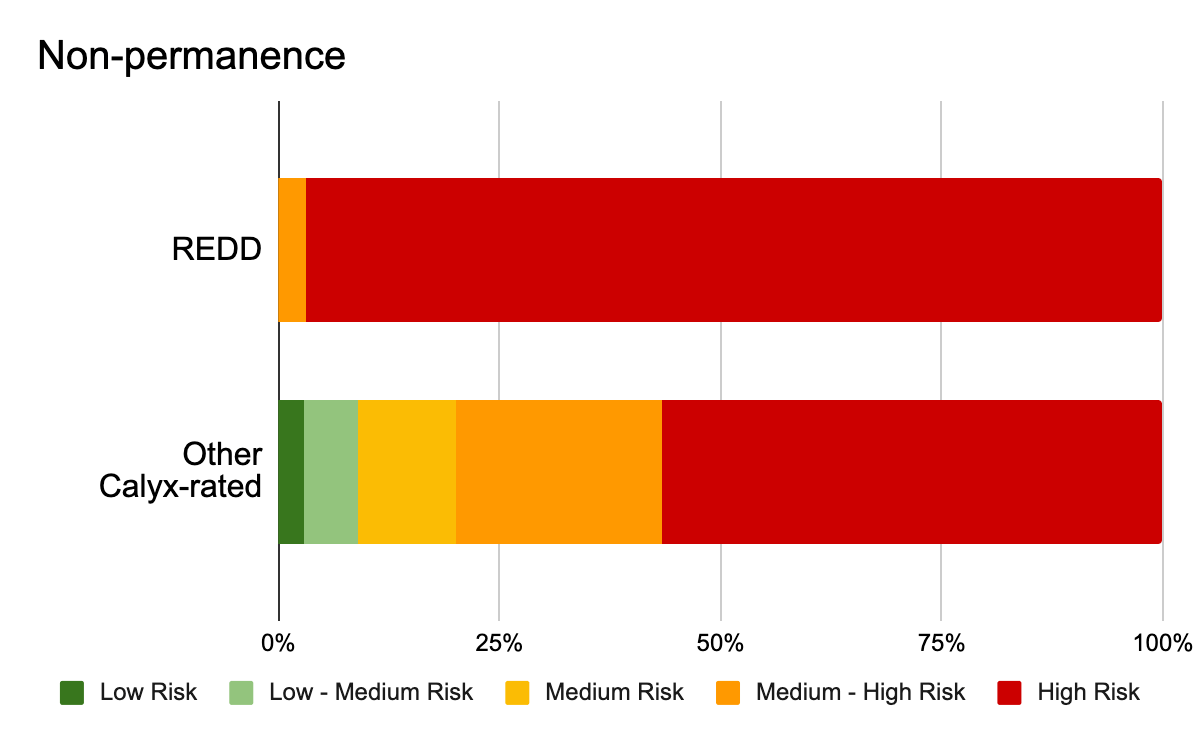

Permanence: Commit to longer periods of monitoring and compensation for reversals. The market – and the atmosphere – want credits to represent a permanent avoided emission or removal, particularly if they are used to compensate for fossil fuel emissions that will stay in the atmosphere for thousands of years. Currently, VCS guarantees permanence only for the duration of the project. Project developers could choose a project lifetime longer than 30 years, though few have. Projects that choose a longer duration fare better in our ratings system because the carbon storage will be monitored, and reversals compensated, for a longer period of time. Verra is considering ways to ensure long term monitoring and compensation. We encourage that effort.

We note that Calyx Global’s assessments for permanence also take into account potential mitigating factors including project design (i.e. can activities be sustained even after carbon revenue stops) and whether the project is located in a supportive environment. In a few cases, we reduce the non-permanence risk where we assess that both of these elements are positive. While we tend to see many well-designed projects, these are often in difficult environments that put into question whether activities can be sustained beyond the project lifetime.

Non-permanence risk is greater in REDD projects than in other project types assessed so far.

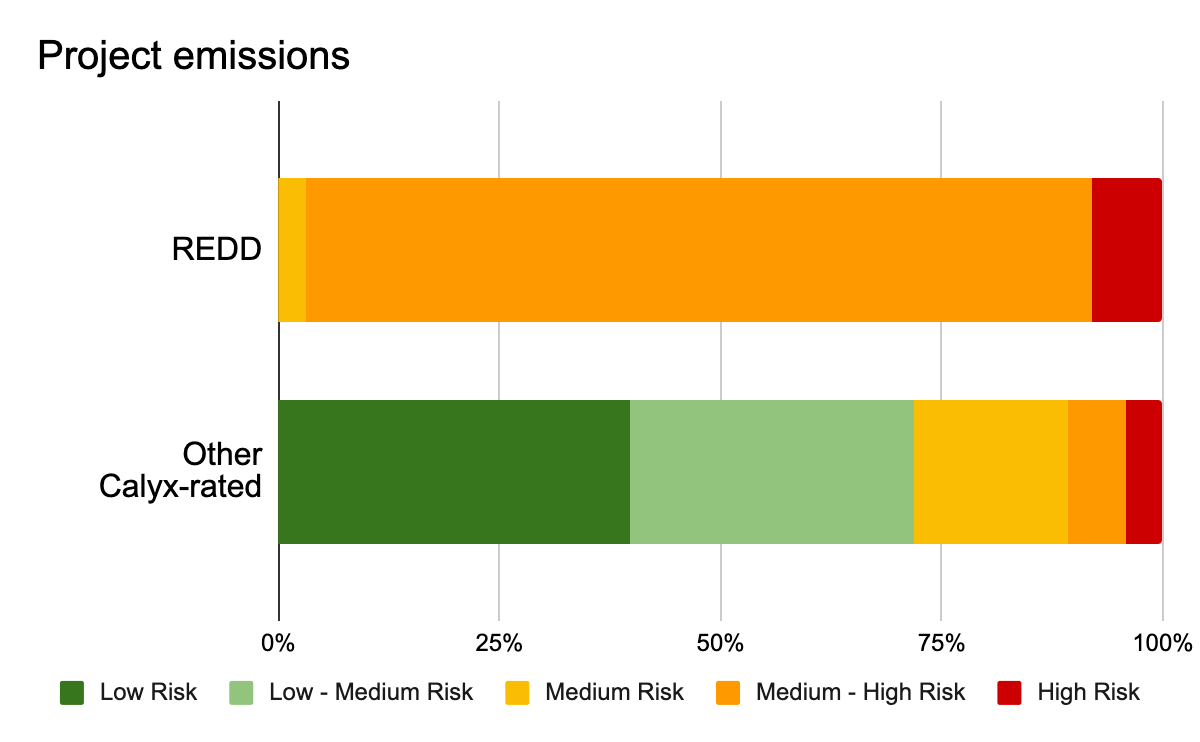

Project emissions: Transparently report the uncertainty of emissions estimates. The amount of emission reductions claimed by a project is determined by subtracting the emissions of observed, actual deforestation from the baseline (the assumed amount of emissions that would have occurred without the project’s activities). While projects often present uncertainty regarding forest carbon stocks, we have yet to find a project that has reported the uncertainty of historical deforestation and deforestation (or deforestation rates) during the crediting period – the key parameter that drives the emission reduction claims. We note that none of the current REDD methodologies requires a comprehensive uncertainty assessment, and therefore we recommend VCS address this gap – and for projects to include this information, even if it is not required.

Risk of underestimated project emissions is higher in REDD projects than in other project types.

Much has been written disparaging the datasets used to assess REDD project claims. However, if projects do not provide an accuracy assessment of, for example, their estimation of forest loss – used both to build the baseline, as well as to estimate project emissions – it is impossible to assess whether the project data is, in fact, better than the independent, peer-reviewed, publicly available data. We look forward to VCS’s new consolidated REDD methodology, which we hope will include requirements for robust uncertainty assessments. This should build confidence in the underlying data.

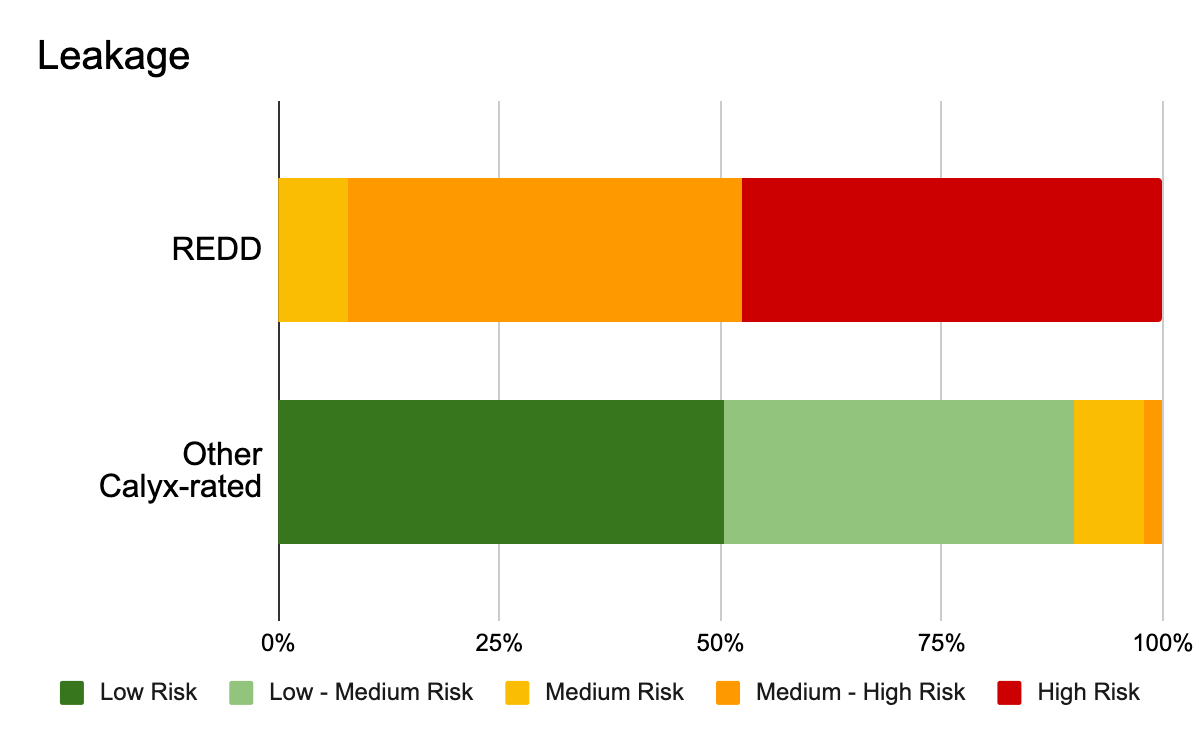

Leakage: Improve leakage identification and estimation. When projects avoid deforestation, activities can shift (‘leak’) and cause deforestation elsewhere. Unaccounted leakage is not unique to REDD; it affects other types of projects as well. However, among the projects rated thus far by Calyx Global, REDD projects have the highest risks.

In 80% of the projects we have assessed, all of the relevant sources of leakage were identified. However, in a small fraction, the project has not accounted for market leakage, despite the role of commodities in driving deforestation. This problem is partly due to the fact that some methodologies do not require accounting for market leakage. Furthermore, a surprising number of projects (around 60%) claim zero leakage. This is because the deforestation that occurs in the “leakage belt” (an area identified by the project as a region where activities may shift) is lower than the amount predicted from applying the project baseline (with the flaws detailed above). Zero leakage seems implausible, particularly for avoided unplanned deforestation.

REDD projects have a higher risk of unaccounted leakage than other project types assessed by Calyx Global thus far.

Overlapping Claims: Coordinate with relevant projects. Some REDD projects may be claiming to protect the same woody biomass that other projects – such as improved cookstoves or household biodigesters – also claim to have conserved. If so, projects should take an appropriate (small) deduction from the total claimed emission reductions. This deduction is not currently required – VCS should consider how to avoid this potential overlapping claim.

Six easy steps and we really should get it right.

REDD benefits go way beyond climate mitigation. Unlike some carbon credit types, REDD has great potential to benefit the people who will be most affected by climate change. Forests are critical to regulating our climate. In areas nearby and far away, forests actively protect human health and the human enterprise – agriculture, infrastructure and cities – from the effects of climate change. REDD credits could be a powerful tool to conserve our forests.

The current market can be improved. A wave of recent reports has highlighted many of the same issues raised by our analysis. None of these findings are particularly new. We call on all stakeholders to recognize the issues in today’s situation and to be a voice for positive change. All of us – buyers, project developers, standards, auditors, ratings agencies, independent expert councils – need to encourage improvements in REDD methodologies and in the way they are implemented.

Finally, while we strongly encourage carbon crediting programs to tighten up REDD methodologies, we also believe that project developers need not wait for new methodologies to commit to raising the GHG integrity of REDD credits by: setting realistic baselines, committing to longer monitoring periods, providing full uncertainty estimates, more robustly accounting for leakage, avoiding overlapping claims and promoting transparency.

What is allowable under current methodologies is not the same as what should be done. Continuing business-as-usual does not help the voluntary carbon market or the planet. By contrast, a REDD renewal can help the market and the planet – we are hopeful for this change and will be looking for projects that Calyx Global can rate highly in the future.Check out our white paper “Turning REDD into GREEN”

- Across all project types, a baseline is assigned a low-medium risk if overestimation is <25%, a medium risk if it is 26-50%, a medium-high risk if it is 51-80% and a high risk if the overestimation is >80%. We currently do not assign a low risk due to the high uncertainty of estimating future forest loss and because no project has yet provided model error.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.