.png)

For a deeper dive into Calyx Global’s ratings for ACM0002 projects, download our ACM0002 Ratings Framework Explainer here.

Calyx Global has released an explanation of its ratings approach for assessing the greenhouse gas integrity of ACM0002 projects, i.e. large-scale grid-connected renewable energy projects. In order to generate consistent ratings across many different sectors, we develop ratings frameworks for each specific project type. These follow an overarching “GHG integrity ratings framework” to ensure comparability across all our ratings.

In this blog, we highlight our key takeaways on the ACM0002 methodology and provide examples of what it takes to improve the rating for projects using this methodology.

What is ACM0002?

First, a brief refresher on what “ACM0002” means. ACM0002 is a methodology for large-scale grid-connected renewable energy projects. The methodology was developed under the UN Clean Development Mechanism and is now used by most major standards to develop and register these types of projects.

ACM0002 risks to Additionality

As we discuss in our ACM0002 ratings framework explainer, large-scale renewable wind, solar and hydropower projects face high risks of non-additionality. The impact of carbon revenue on the financial outlook of these projects is relatively small. Carbon revenue is intended to turn financially unattractive projects into an attractive proposition for investors, thereby incentivizing greater greenhouse gas removal or emissions avoidance than would have otherwise happened. Unfortunately, projects are not required by the methodology to demonstrate the impact of carbon revenue in their financial analysis, which Calyx Global views as a risk.

Other additionality risks may arise when a project does not provide evidence of prior consideration to develop the energy facility as a carbon project. This is a requirement for additionality in the ICVCM’s assessment framework. Our ACM0002 ratings framework is aligned with this principle; however, not all carbon crediting programs require a project to provide this evidence.

Calyx Global also assesses whether the technology type was common (and less likely to be additional) based on the installed capacity of that technology type on the electrical grid. For instance, if 65% of the electrical grid is comprised of hydroelectric energy, then ACM0002 hydroelectric projects are less likely to be additional within that grid’s region.

Another important issue that affects additionality for ACM0002 projects is government involvement in a project’s development. As we note in our ACM0002 paper, Calyx Global assesses the financial incentives that are provided by governments to develop renewable energy projects. In addition, some projects are developed outright by the government. Government ownership of ACM0002 projects poses a serious risk for additionality. When projects are government-owned, their development is less likely to be motivated by carbon revenue since government entities are often not focused on ‘turning a profit’ with their investments, and may pursue energy development for other strategic goals (e.g. promoting the public good by ensuring energy availability).

Other risks under ACM0002

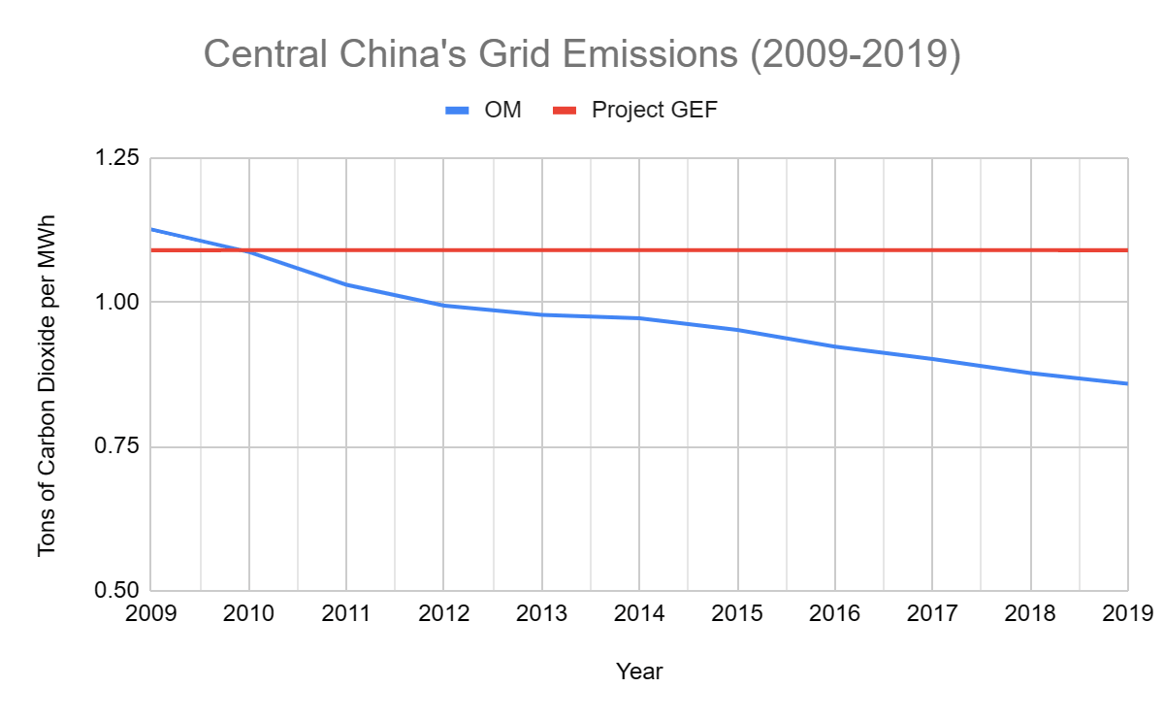

Other risk factors that affect ACM0002 projects arise from over-crediting and overlapping claims. In general, the risk of over-crediting is determined by the project’s calculation of the region’s grid emission factor (GEF), and whether the GEF calculation is updated regularly.  At the start of the project in this example, the GEF is calculated conservatively and does not overestimate the emissions reductions of the project. However, over time, the grid has become ‘greener’, and the project’s GEF will overestimate emission reductions. Note that the operating margin (OM) line represents the actual emission factor of the electrical grid over time.

At the start of the project in this example, the GEF is calculated conservatively and does not overestimate the emissions reductions of the project. However, over time, the grid has become ‘greener’, and the project’s GEF will overestimate emission reductions. Note that the operating margin (OM) line represents the actual emission factor of the electrical grid over time.

Many projects use an ex-ante calculation; as in the example above, the project calculates its GEF at the start of the crediting period, and does not update the calculation throughout the crediting period. When the grid becomes “cleaner” over time, the actual emission factor of the grid decreases, making the project’s emission factor outdated, and resulting in overestimated emissions reductions.

Overlapping claims arise when the project participates in other offset programs, such as state-run cap-and-trade systems or renewable purchase obligations (RPOs). Energy projects that receive renewable energy certificates (RECs) can also have a risk of overlap with carbon credits.

How to achieve higher ratings from Calyx Global

- Document well, and early!

Two areas in which Calyx Global emphasizes the importance of clear documentation are prior consideration and the financial analysis. Projects that provide thorough documentation of their intent to develop the energy facility as a carbon project will reduce their risks of non-additionality. Prior consideration is fundamental to the project’s additionality. It is also critical to provide a robust financial analysis that considers the impact of carbon revenue on the project’s financial attractiveness.

- Update the GEF regularly

In order to achieve high integrity, ACM0002 projects should use a conservative GEF estimate throughout the crediting period. Conservative estimates can be ensured through the use of an ex-post calculation of the GEF, whereby the calculation is updated with each monitoring report.

- Reduce the risk of overlapping claims

Projects that qualify for state-led programs like cap-and-trade programs should clearly document that they do not participate in these programs. Furthermore, they should not pursue renewable energy certificates (RECs) during the same periods that they issue carbon credits.

For a deeper dive into Calyx Global’s ratings for ACM0002 projects, download our ACM0002 Ratings Framework Explainer here.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.