.png)

In our recent webinar, “The hunt for quality, lessons learned from analyzing 400+ projects,” Calyx Global co-founder Donna Lee was joined by Taylor Wright, Head of Strategy and Carbon Management of JPMorgan Chase & Co., and Randall Spalding-Fecher of Carbon Limits (and Chair of Calyx Global’s GHG Integrity Panel) as each shared lessons learned in their carbon market journey. So, what are some of the major takeaways?

1. Some quality trends exist, but they aren’t across the boardAs Donna noted, there can be a correlation between carbon credit quality and specific methodologies or project types. Some project types tend to score higher in terms of carbon credit quality. However, most commonly, we see a range of ratings for a given project type and/or methodology.

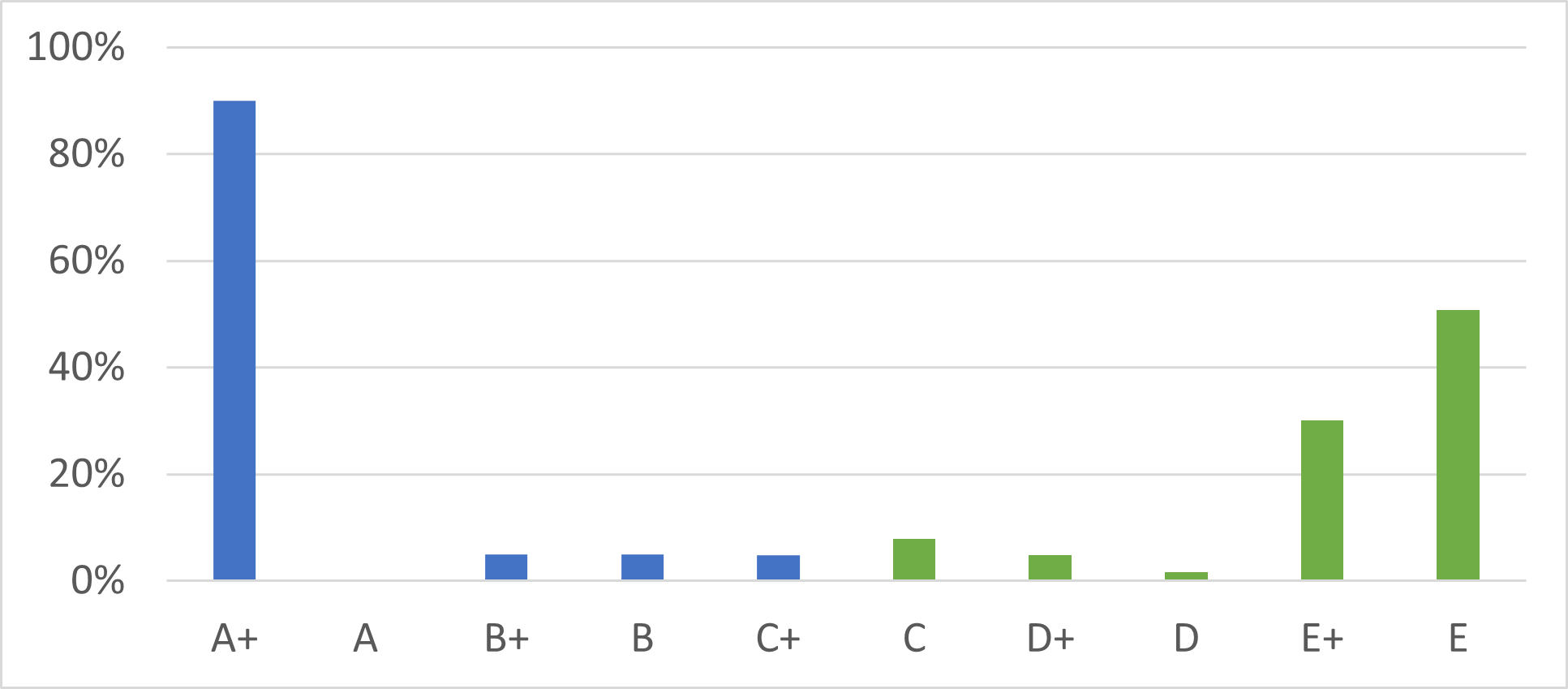

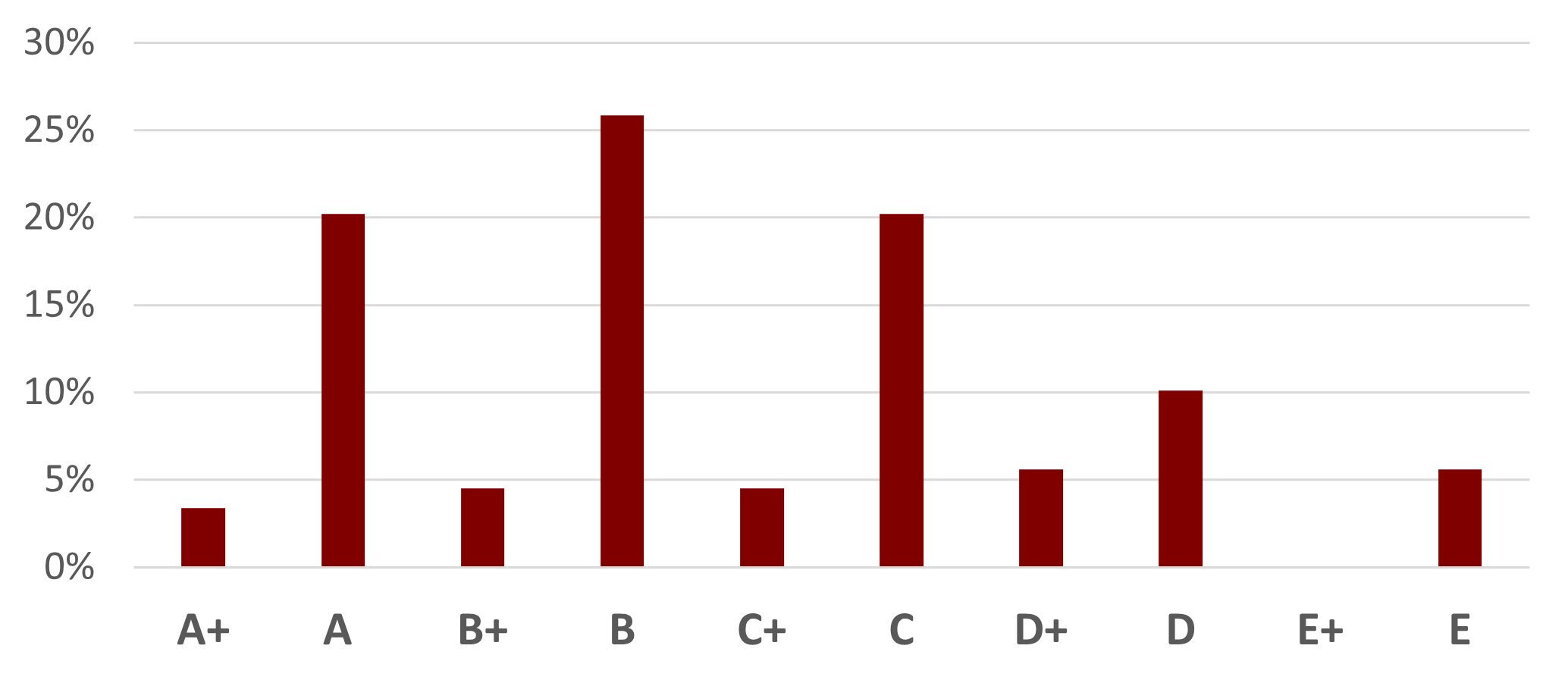

For example:

The blue project type here tends to score high, while the green project type averages towards low ratings of greenhouse gas integrity.

Most project types, however, have a wider distribution of ratings, which is why we rely on a project-level assessment.

In general, Donna also noted the relationship between project size and carbon credit quality, which tends to have an inverse correlation- the bigger the project, the less likely it is to demonstrate high greenhouse gas integrity. This is especially important since larger projects generate more carbon credits.

In the webinar, Donna talked further about the project types that tend towards higher greenhouse gas integrity and SDG impact. Watch now for more insights.

2. The ICVCM’s CCPs are an important component in identifying high-quality carbon credits, and set a valuable “minimum bar” - nevertheless, there is a spectrum of quality

The Core Carbon Principles (CCPs) by the ICVCM produce guidance on the “minimum bar” criteria that a carbon project must meet in order to demonstrate greenhouse gas integrity. With the development of the CCPs by the ICVCM, we expect carbon projects to take additional steps to ensure they meet these minimum standards of integrity.

In many ways, the CCPs align with the ratings process used by Calyx Global (this is unsurprising, considering the role of Donna Lee and other Calyx Global affiliates on the panel of the ICVCM). The development of the CCPs has led some to question whether carbon credit ratings are necessary anymore. However, while the ICVCM draws a “line in the sand” for carbon credit quality, there is still a lot of room for gradation in quality beyond that line. That, Donna says, is where carbon credit ratings agencies come in, to spur a “race to the top'' of greenhouse gas integrity.

Learn more in our series on the ICVCM and core carbon principles.

3. It’s possible to participate in the carbon market with less riskThe majority of sustainability teams are aware of the headlines and feel some level of hesitation to engage in the carbon market, but Taylor Wright shared how JP Morgan Chase has managed that risk. She spoke to the importance of transparency when corporates engage with the carbon markets. That transparency goes a long way towards establishing good faith in a company’s climate strategy and intentions, which leads to less accusations of greenwashing. As she notes from her experience at JP Morgan Chase, “We don’t have to have it all figured out on our own, but being transparent about how we’re thinking about it is what will help corporates get more comfortable being more active players in the market.”

Taylor also noted that many companies don’t have the internal expertise to make informed decisions when buying carbon credits. She offered words of encouragement to engage and offered solutions such as carbon credit rating agencies and the ICVCM CCPs to help fill in some of the gaps at a corporate level.

During the webinar, all panelists came together around one important concept –– inaction is a choice as much as action is. For corporates who are worried about getting “bad press” due to their involvement in the carbon market, Donna suggested taking a hard look at the offset claim they are trying to make through their investment, as these claims can draw criticism when they aren’t well-grounded. Taylor also added that before turning to offsets, corporates should start by reducing their own emissions as much as possible. Randall also noted that the early days of carbon markets lacked many of the tools we see today to assess risk and methodologies are learning and improving upon their early iterations. Simply put, all panelists agreed that in today’s market, it is possible to take action on your climate goals with less risk.

In the webinar we dive deeper into these themes and more. View the on-demand recording.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.