In this blog we explain why carbon credit ratings are needed alongside the ICVCM’s efforts to set a minimum bar.

Many companies are eagerly awaiting the Integrity Council for Voluntary Carbon Markets (ICVCM) to “tag” credits that meet its “Core Carbon Principles” (CCPs). The ICVCM suggests that some credits may receive the tag as early as later this year.

The question many ask is: Will carbon credit ratings still be necessary to distinguish quality?

The ICVCM is setting a minimum bar for quality

A minimum bar is valuable for the market because – if it works well – it will send a signal to the market about a “floor” of quality.

It is useful to understand how the ICVCM will “tag” projects in order to understand what they will mean for the market. The ICVCM will assess “categories” of credits, which are basically certain project types that use particular carbon methodologies. For example, they may assess renewable wind projects using CDM’s ACM0002 methodology, or REDD projects using VCS VM0007.

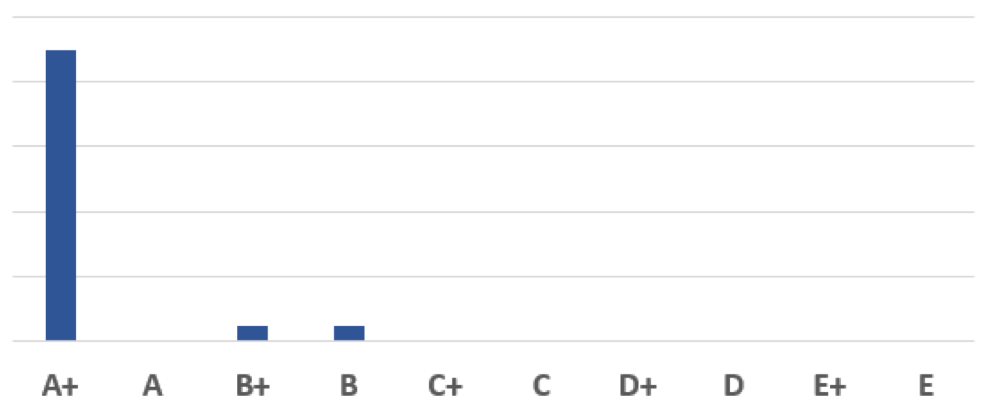

In some cases, this approach can be quite effective at labeling high-quality credits. For example, the illustration below is Calyx Global’s ratings for a particular project type using a particular methodology. In this instance, the projects should receive the CCP label as it appears this particular category of projects has consistently high-quality outcomes.

Figure 1: Calyx Global ratings for one particular project type using a specific methodology

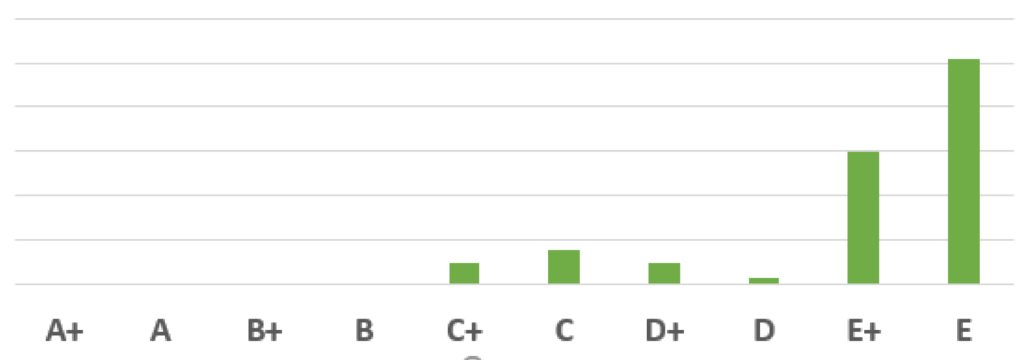

Conversely, some project type-methodology combinations result in consistently low-quality outcomes as illustrated by the figure below. In this instance, the ICVCM can usefully signal to the market that this category is not sufficiently robust for offsetting.

Figure 2: Calyx Global ratings for another project type using a specific methodology

But sometimes it is challenging to use the “category” tool to assess quality

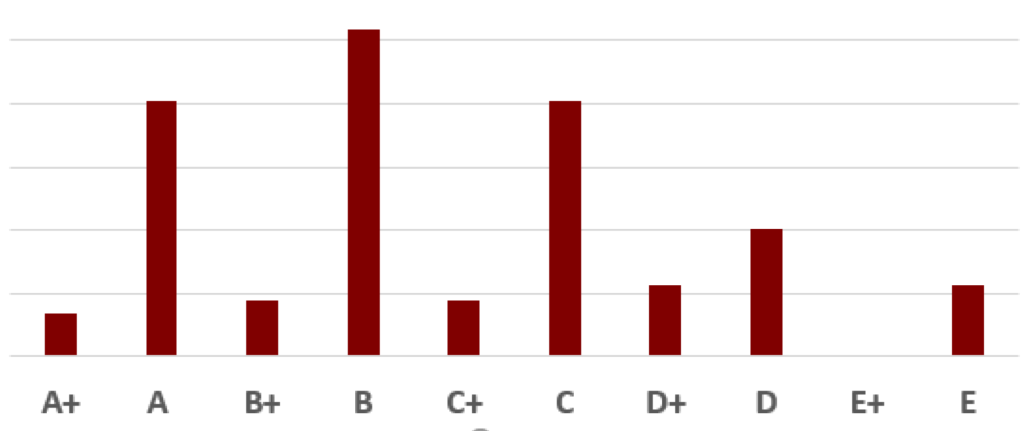

However, there are also many project type-methodology combinations that have highly diversified outcomes, where project-level analysis will be needed. Sometimes it is not possible to make a clear judgment about a ‘category’, even if one tries to parse the category more finely – some issues will be project-specific, where only a project-by-project analysis can reveal higher versus lower quality.

Figure 3: Calyx Global ratings for a third project type using a specific methodology

It might be that – for some categories – it can be nearly impossible to develop a “one size fits all” methodology that will guarantee high quality in every instance. And there is a balance: a highly constrained methodology may narrow the scope such that very little mitigation happens – but if it is too flexible, quality issues may abound.

Conclusion: Creating a race to the top

Wherever the ICVCM lands on drawing a line in the sand, there will always be projects that perform better or worse than the majority of their peers, yet get grouped with them anyway. Projects like these are what we’ve heard called the “babies in the bathwater,” or “bad apples spoiling the entire lot.” Sorting out the apples and babies takes project by project analysis. The ICVCM, however, does a huge service to the market by defining “integrity” and pushing methodologies to improve.

Furthermore, there will also be a range of quality above the line. The mission of Calyx Global is to increase the impact of carbon markets. We work with companies who want to go ‘above and beyond’ and are willing to dedicate themselves to finding higher quality credits.

To learn more about how Calyx Global aligns with the ICVCM, see our previous post, How Calyx Ratings are aligned with the ICVCM CCPs, in our ICVM Insights series.Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.