Originally published on April 8, 2024 and updated on May 2, 2024.

On April 5, the ICVCM announced the first carbon crediting programs eligible to use the ICVCM Core Carbon Principles (CCP) label. On May 2, the ICVCM announced two additional programs that received this same eligibility.

The ICVCM’s label is intended to identify high-quality carbon credits according to ICVCM standards. To be clear, this does not mean that all credits under the programs can now be CCP labeled. This is only the first step for credits to receive the CCP label.

The pathway to a credit receiving the CCP label involves two parts, which the ICVCM is now calling the “two-tick” approach, both of which must be met:

- A credit must be registered under a carbon crediting program that receives eligibility; and

- The credit’s “category” must also receive eligibility. A category is a project type (e.g. landfill gas, improved forest management, efficient cookstoves, etc.) combined with a particular methodology (e.g. ACM0001, VM0012, GS TPDDTEC, etc.).

Part I: Carbon Crediting Program Eligibility

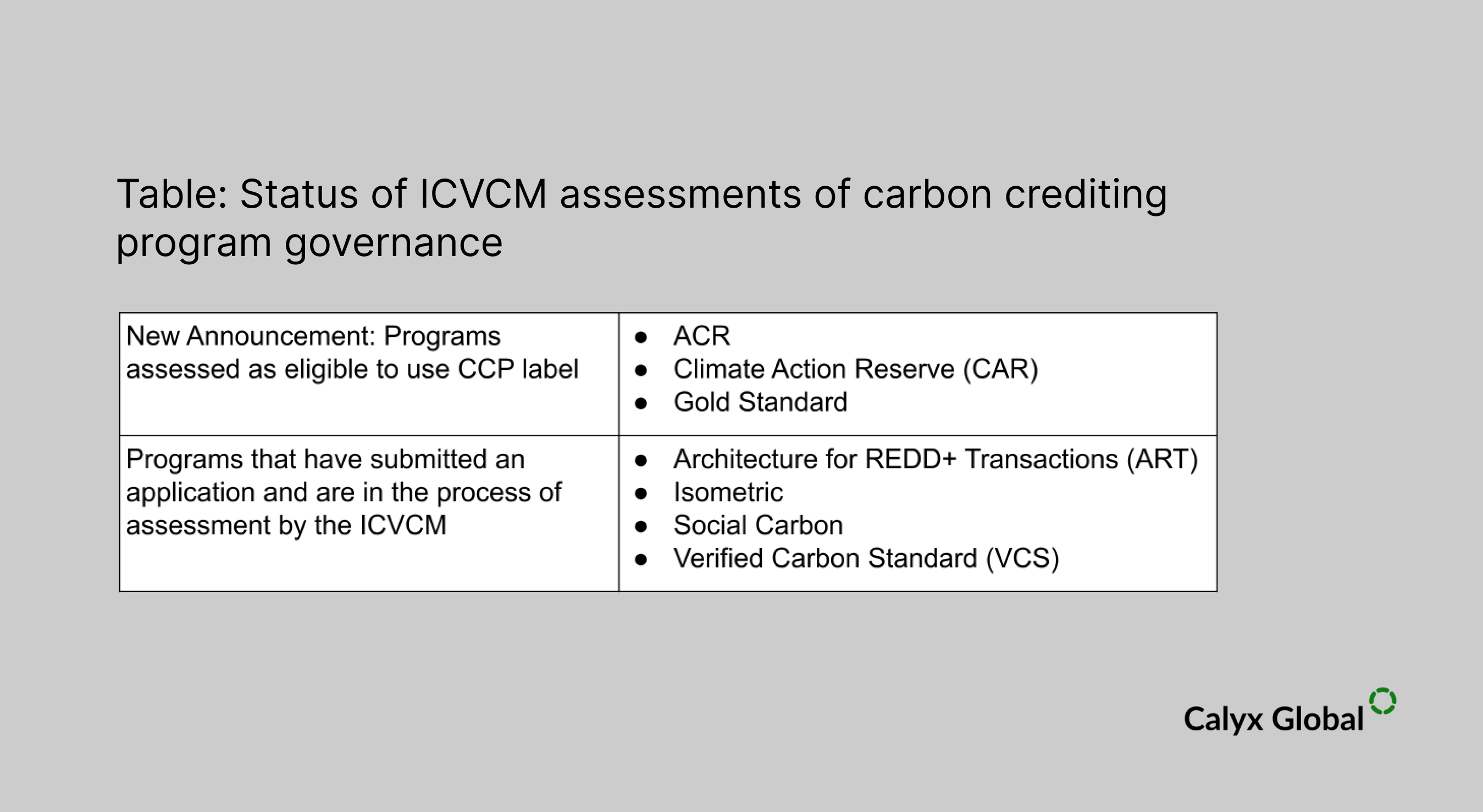

Carbon crediting programs must provide information and pass a minimum threshold related to a range of governance, quantification and safeguard-related issues to become eligible. Three programs were given this status: ACR, Climate Action Reserve (CAR), and the Gold Standard. Four other programs have applied and are undergoing assessments.

It appears that, in order to become eligible for this stage of the ICVCM labeling, each of the programs made changes to their program. We take this as a positive sign that the ICVCM is creating positive changes in the Voluntary Carbon Market (VCM). Below is a summary of the changes taken by each program.

CAR made changes to its Reserve Offset Program Manuel, issuing a new Version 9.1. The changes included clarifying several governance issues (including conflict of interest policies), requiring projects to report on non-GHG benefits that align with the United Nations Sustainable Development Goals (SDGs), clarifying the types of leakage considered for project accounting, clarifying its “regulatory surplus” and performance standard tests for additionality, tightening up its requirements on project documentation and its protocol and program review process. Importantly, CAR strengthened its Environmental and Social Safeguards and requirements for local stakeholder consultations and its grievance processes.

We also note that CAR moved some of the protocol-specific requirements into its standard. We applaud CAR for going “above-and-beyond” the ICVCM requirements for Permanence, requiring projects to monitor and verify for 100 years following the issuance of any carbon credit with reversal risks. CAR also only uses its buffer mechanism for unavoidable reversals (e.g. natural disturbances) but holds project owners responsible for avoidable (man-made) reversals. This was also in their protocols, but moved to the standard and therefore will apply to all reversal-prone credits going forward. This is, currently, the best practice we have seen in the Voluntary Carbon Market (VCM).

ACR and ART committed to producing their own financial reports starting this year (rather than integrating into its parent company Winrock). It appears both of the programs had the least changes to make in complying with the ICVCM’s requirements.

The Gold Standard was requested to make four changes. They have already made two of the changes related to registry requirements: identifying “the entity on whose behalf credits are retired” and the purpose of retirement for all credits. The other two are not yet resolved, but the ICVCM has determined they are “minor changes” that do not affect the program’s eligibility: formalizing its anti-money laundering procedures into a single cohesive document and publishing a comprehensive set of guidelines to clarify its approach and requirements to assessing overall uncertainty of emission reductions or removals. The ICVCM will provide oversight to ensure those changes are made.

The Verified Carbon Standard (VCS) made a number of changes to align with the ICVCM requirements. These included an updated Grievance Redress Policy, a new Performance Monitoring Program to improve the transparency of the auditing process, stronger risk mitigation (also known as safeguards) requirements and transparency on benefit-sharing and others.

We welcome all these improvements made by carbon crediting programs and the alignment of quality driven by the ICVCM process.

Part II: Category Eligibility

Now comes the harder part. The ICVCM has been working, in parallel, assessing a range of categories for the CCP label based on whether they meet a separate set of criteria.

The number of categories that meet the criteria is likely to be limited this year. This will constrain the number of credits that will receive the CCP label. A number of analyses have been done on the percentage of credits that might receive the label. It is very difficult, however, to know because assessing categories is not straightforward. Some subjective judgment will be involved, which, at the end of the day, is in the hands of the ICVCM Board.

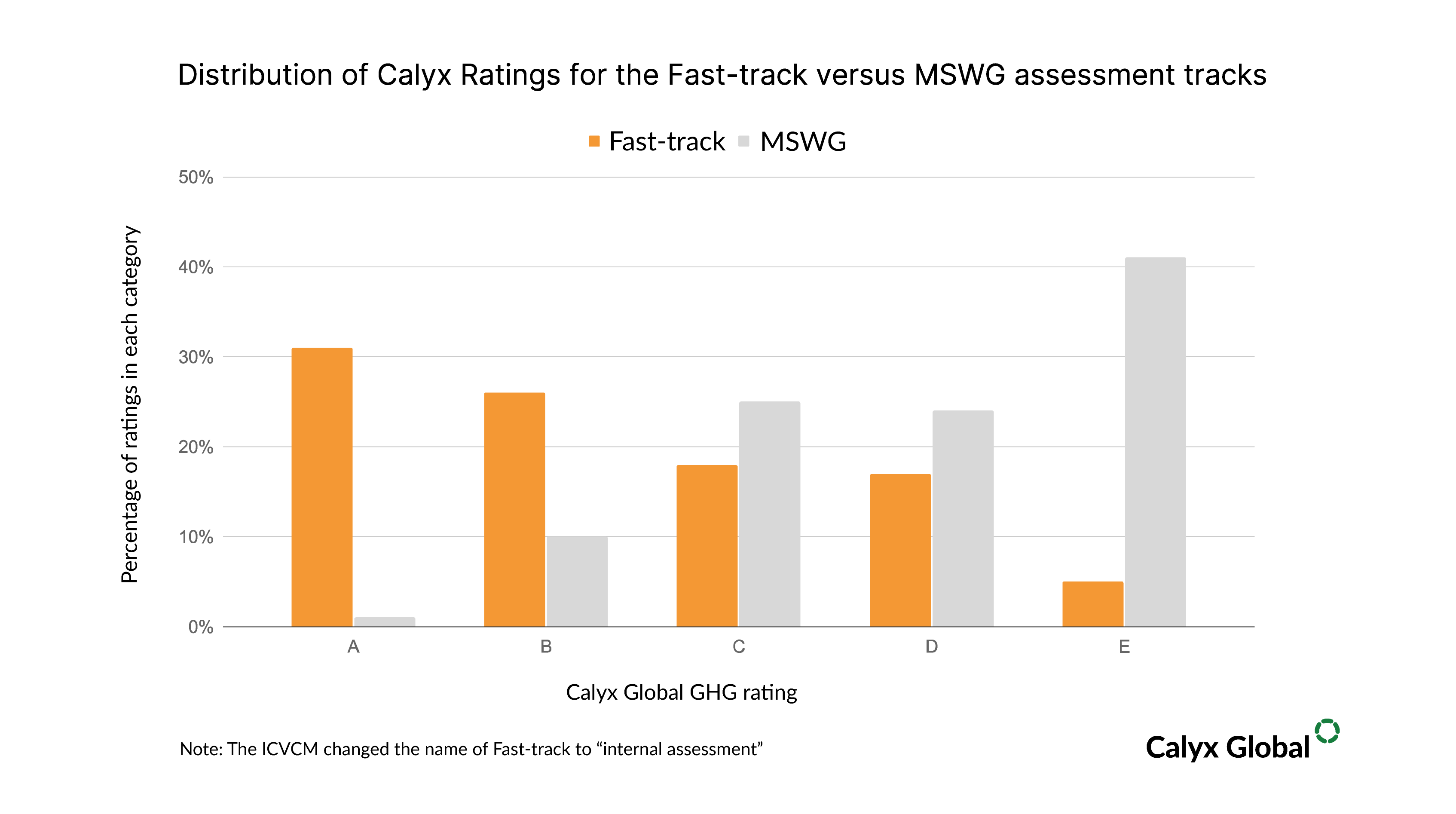

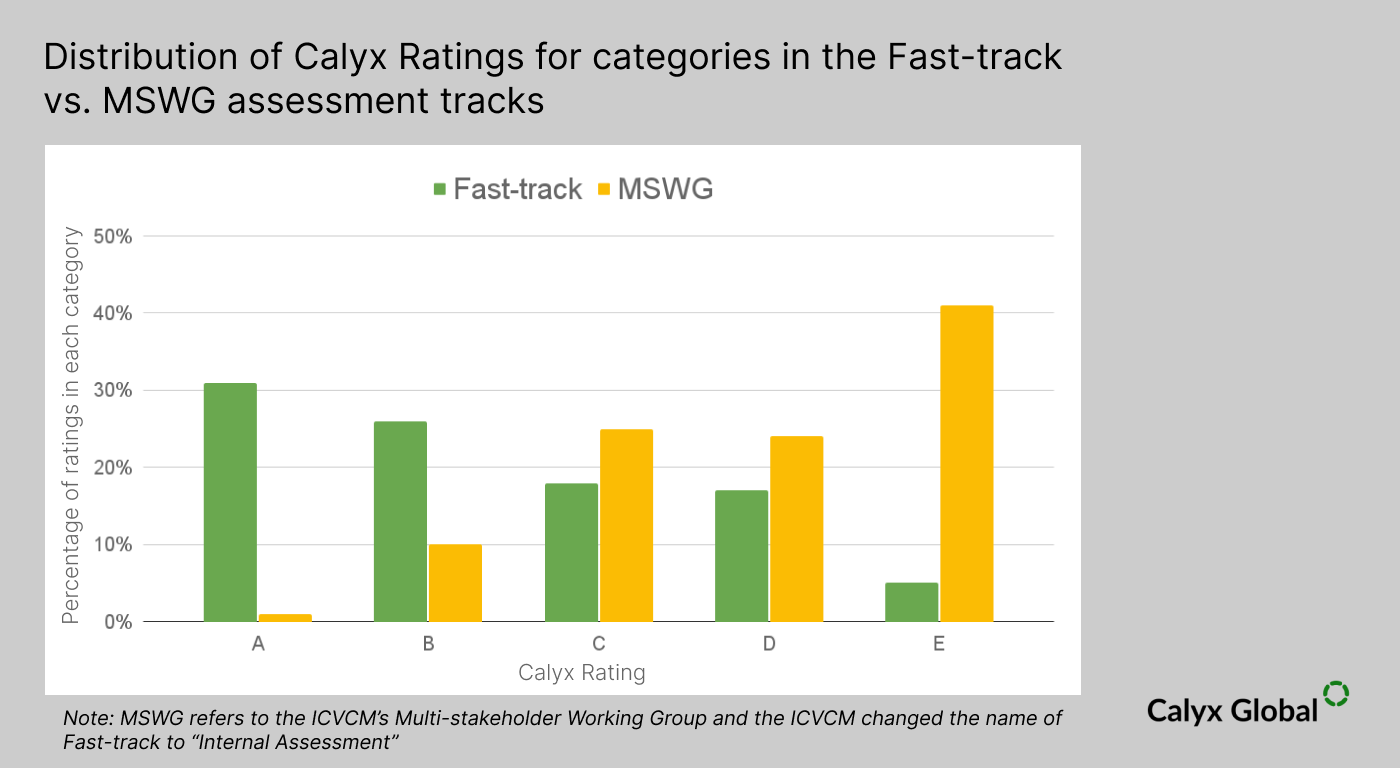

What we do know at Calyx Global is that there is a limited supply of higher-quality credits in the market. We wrote a blog post about the ICVCM categories in February that compared our ratings with the two tranches created by the ICVCM: (a) those formerly called “fast-track” (and now called “internal assessment”) that were originally deemed to be more likely to meet the CCP criteria and (b) those slated for “multi-stakeholder working groups,” assumed to be of mixed quality and requiring more discussions among experts.

While it appears that many projects can be deemed high quality in the “fast track” categories, we note that the image below is by the percentage of ratings (per project), not by the volume of issuances. Larger projects tend to have lower ratings, which we wrote about in another blog post.

What’s Next?

The ICVCM announced that the first set of categories eligible for the CCP label will be selected in April and May. However, it has not provided exact dates for the decisions. Rather, it suggested that announcements will be made on a monthly basis after each Board meeting.

However, the ICVCM has a website where one can track progress on the various category assessments. Several categories have moved to “Preparing draft evaluation report and recommendation” but none have yet moved to “Scheduled for governing board consideration.”

We look forward to the ICVCM's first announcements, which will generate the first CCP-eligible credits.

To receive updates on the first ICVCM categories when they release, sign up for our newsletter.

On Friday, the ICVCM announced the first carbon crediting programs eligible to use the ICVCM Core Carbon Principles (CCP) label. The ICVCM’s label is intended to identify high-quality carbon credits according to ICVCM standards. To be clear, this does not mean that all credits under the programs can now be CCP labeled. This is only the first step for credits to receive the CCP label.

The pathway to a credit receiving the CCP label involves two parts, both of which must be met:

- A credit must be registered under a carbon crediting program that receives eligibility; and

- The credit’s “category” must also receive eligibility. A category is a project type (e.g. landfill gas, improved forest management, efficient cookstoves, etc.) combined with a particular methodology (e.g. ACM0001, VM0012, GS TPDDTEC, etc.).

Part I: Carbon Crediting Program Eligibility

Carbon crediting programs must provide information and pass a minimum threshold related to a range of governance, quantification and safeguard-related issues to become eligible. Three programs were given this status: ACR, Climate Action Reserve (CAR), and the Gold Standard. Four other programs have applied and are undergoing assessments.

It appears that, in order to become eligible for this stage of the ICVCM labeling, each of the programs made changes to their program. We take this as a positive sign that the ICVCM is creating positive changes in the Voluntary Carbon Market (VCM). Below is a summary of the changes taken by each program.

CAR made changes to its Reserve Offset Program Manual, issuing a new Version 9.1. The changes included clarifying several governance issues (including conflict of interest policies), requiring projects to report on non-GHG benefits that align with the United Nations Sustainable Development Goals (SDGs), clarifying the types of leakage considered for project accounting, clarifying its “regulatory surplus” and performance standard tests for additionality, tightening up its requirements on project documentation and its protocol and program review process. Importantly, CAR strengthened its Environmental and Social Safeguards and requirements for local stakeholder consultations and its grievance processes.

We also note that CAR moved some of the protocol-specific requirements into its standard. We applaud CAR for going “above-and-beyond” the ICVCM requirements for Permanence, requiring projects to monitor and verify for 100 years following the issuance of any carbon credit with reversal risks. CAR also only uses its buffer mechanism for unavoidable reversals (e.g. natural disturbances) but holds project owners responsible for avoidable (man-made) reversals. This was also in their protocols, but moved to the standard and therefore will apply to all reversal-prone credits going forward. This is, currently, the best practice we have seen in the Voluntary Carbon Market (VCM).

ACR committed to producing its own financial reports starting this year (rather than integrating into its parent company Winrock). It appears ACR had the least changes to make in complying with the ICVCM’s requirements.

The Gold Standard was requested to make four changes. They have already made two of the changes related to registry requirements: identifying “the entity on whose behalf credits are retired” and the purpose of retirement for all credits. The other two are not yet resolved, but the ICVCM has determined they are “minor changes” that do not affect the program’s eligibility: formalizing its anti-money laundering procedures into a single cohesive document and publishing a comprehensive set of guidelines to clarify its approach and requirements to assessing overall uncertainty of emission reductions or removals. The ICVCM will provide oversight to ensure those changes are made.

Part II: Category Eligibility

Now comes the harder part. The ICVCM has been working, in parallel, assessing a range of categories for the CCP label based on whether they meet a separate set of criteria.

The number of categories that meet the criteria is likely to be limited this year. This will constrain the number of credits that will receive the CCP label. A number of analyses have been done on the percentage of credits that might receive the label. It is very difficult, however, to know because assessing categories is not straightforward. Some subjective judgment will be involved, which, at the end of the day, is in the hands of the ICVCM Board.

What we do know at Calyx Global is that there is a limited supply of higher-quality credits in the market. We wrote a blog about the ICVCM categories in February that compared our ratings with the two tranches created by the ICVCM: (a) those formerly called “fast-track” (and now called “internal assessment”) that were originally deemed to be more likely to meet the CCP criteria and (b) those slated for “multi-stakeholder working groups,” assumed to be of mixed quality and requiring more discussions among experts.

While it appears that many projects can be deemed high quality in the “fast track” categories, we note that the image below is by the percentage of ratings (per project), not by the volume of issuances. Larger projects tend to have lower ratings, which we wrote about in another blog post.

What’s Next?

The ICVCM announced that the first set of categories eligible for the CCP label will be selected in April and May. However, it has not provided exact dates for the decisions. Rather, it suggested that announcements will be made on a monthly basis after each Board meeting.

However, the ICVCM has a website where one can track progress on the various category assessments. Several categories have moved to “Preparing draft evaluation report and recommendation” but none have yet moved to “Scheduled for governing board consideration.”

We look forward to the ICVCM's first announcements, which will generate the first CCP-eligible credits.

To receive updates on the first ICVCM categories when they release, sign up for our newsletter.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.