Last week the Science Based Targets Initiative (SBTi) updated its recommendations and methods for companies to reduce their emissions impact through new “Beyond value chain mitigation” (BVCM) guidance, which refers to investments into, e.g. forestry or energy efficiency projects that reduce emissions unrelated to their value chain. SBTi issued two reports:

-

Above and beyond: an SBTi report on the design and implementation of BVCM explains the rationale behind the new guidance, including the business case for BVCM; it also provides design and implementation ideas for companies to develop a BVCM strategy.

-

Raising the bar: an SBTi report on accelerating corporate adoption of BVCM complements the report above by providing a “toolkit” for increasing corporate finance into the BVCM recommendations; this report is useful for organizations looking to adopt the recommendations listed in the Above and Beyond report.

We believe that our ratings help companies develop strategies that can align with the new SBTi guidance.

What is BVCM?

In 2021, SBTi published a “Corporate Net-Zero Standard.” The standard provides guidance for corporates to:

-

Set near and long-term targets to reduce “within value chain” emissions

-

Neutralize residual emissions with durable carbon removals

-

Take action “beyond the value chain.”

The new guidance focuses on the last bullet: Beyond Value Chain Mitigation. BVCM is defined as “mitigation action or investments that fall outside a company’s value chain, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere.” It is a mechanism for companies to go above and beyond their science-based targets by funding global mitigation efforts.

What does the new guidance mean for companies?

A key to understanding the new BVCM guidance is to focus on its two goals. Companies may choose to pursue one or the other option, or a combination of the two goals:

-

Delivering near-term mitigation, and

-

Driving finance to scale up climate solutions and enable activities to “unlock the systemic transformation needed to achieve net zero by mid-century globally.”

The first goal is largely how most companies have been tackling their climate targets, i.e. by purchasing carbon credits and using them as “offsets” for their residual emissions, i.e. using credits as compensation for emissions that are “hard to abate” in the near term. This is called the “ton-for-ton” approach. SBTi recommends companies working to achieve this goal should report the mitigation outcomes achieved.

The second goal opens up a new approach – for companies to consider contributions to climate change when setting up their BVCM climate goals. It focuses on “driving finance” to climate action. How much finance should a company provide? SBTi offers two approaches: (a) The “money-for-ton” approach, whereby a company sets a carbon price for unabated emissions and deploys that towards climate action; or (b) a company allocates a share of revenue or profit towards funding climate mitigation (called the “money-for-money” approach). In this instance, SBTi recommends companies should report on the finance deployed towards the mitigation interventions, as well as the mitigation outcomes and co-benefits delivered through that finance.

Companies can use Calyx Global ratings to report on BVCM portfolios

The important recommendation – and the one that will protect a company’s reputation – is for companies to “make transparent and accurate BVCM claims.” Calyx Global ratings can help companies make claims supported with evidence, analysis and a credit rating, whether they choose to make compensation or contribution claims.

Compensation claims: purchase credits with high GHG integrity ratings. The media has, to date, targeted companies that are offsetting, or making compensation claims. This is particularly the case where the carbon credit used does not represent one tonne of greenhouse gas mitigation. Calyx Global provides companies with our unvarnished assessments of carbon credits. If companies are using carbon credits for compensation claims, they should drive towards credits that have high GHG integrity ratings.

Contribution claims: use Calyx Ratings to report on GHG and SDG outcomes. Where should a company put money if they decide to contribute to climate action using the money-for-ton or money-for-money option? We still believe that carbon credits can be a useful option, particularly in the near term, where there are few credible opportunities to finance climate action. The benefit of carbon credits is that there is a structure in place – with standards, third-party auditing and certification that can provide certain assurances.

However, we also know that many credits do not achieve their GHG claims, and that there are highly varying degrees of contributions to the UN Sustainable Development Goals (SDGs). Ratings provide clarity on what a company can report if they purchase carbon credits – both GHG and SDG claims. Calyx Global ratings and in-depth assessments can help a company make reliable claims when reporting how a company is compensating for emissions, or contributing finance to climate change and sustainable development.

Calyx Global ratings can also help companies select credits for BVCM portfolios

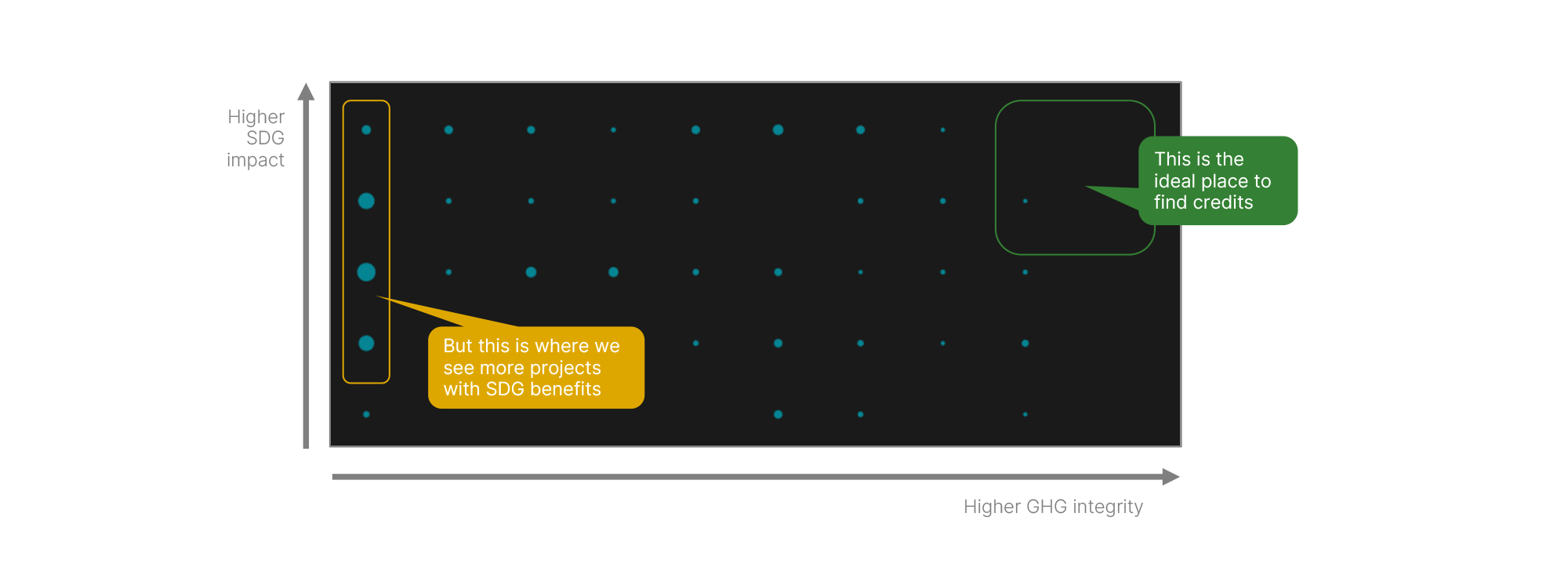

One issue we see in today’s carbon market is that there is a trade-off between quality and charisma. Many companies want to support, for example, forest or nature-based projects. However many of these currently suffer from low-quality GHG claims. This is particularly true of forest conservation (REDD) credits.

Note: The size of the bubbles represents the # of projects in each category.

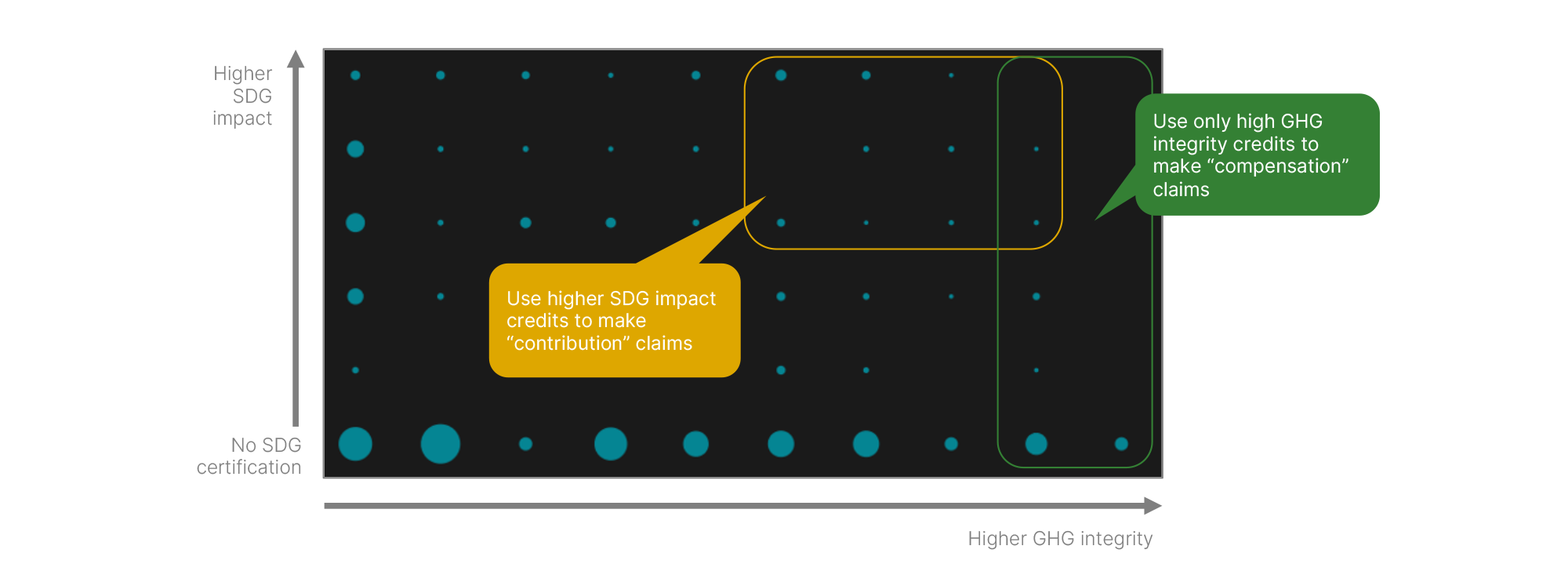

The new SBTI guidance opens the door for companies to support a wider range of credits without suffering reputational risks. For example, a company could decide to offset, or compensate for, 50% of its hard-to-abate emissions. In this instance, it may select Calyx Global A-rated credits. Many of these do not have additional benefits and, for that reason, do not pursue certification for SDG contributions.

For the other 50% of a company's residual emissions, it may decide to finance climate action. This does not mean it can finance anything – there are important decisions a company needs to make and SBTi guidance still expects reporting on mitigation outcomes, as well as the additional benefits from the finance.

From a climate equity perspective, however, it is useful to consider how to support projects that deliver strong SDG contributions, while still delivering reasonable mitigation benefits. In this case, a company may decide to purchase credits with high Calyx Global SDG ratings. The credits should still support GHG mitigation, however. For example, the credits should still be “additional” (i.e. provide clear evidence that the actions would not occur without the carbon finance) but may represent a credit type where there is not yet a scientific basis for robust quantification or data availability is weak. Credits may also have non-permanence risk but still commit to longer-term monitoring and quantification. The important thing, as noted above, is to simply be transparent and forthcoming about the claims.

If companies were to consider such criteria for contribution claims, the range of credits may expand to include a different set than those available for compensation claims, as illustrated below.

Note: Calyx Global does not currently take a view on where to draw lines for compensation vs. contribution claims. The image above is only illustrative.

Finally, we note that the BVCM guidelines suggest that companies should define guardrails and commit to “safeguarding” principles to ensure BVCM activities do not have an adverse social or environmental impact. Currently, Calyx Global is the only carbon credit ratings agency that offers a social and environmental risk screening for carbon projects. Read more about our new Safeguard work here.

To learn more about how Calyx Global can help you align with the new BVCM guidelines, request a demo of our carbon credit ratings and insights platform.

Get the latest delivered to your inbox

Sign up to our newsletter for the Calyx News and Insights updates.